Previously I had written about the sequence of returns and how investment results in the future can be dramatically different, especially if you are simply using a single “average” rate of return. In retirement we also expect to take distributions from our investment accounts to provide income. How to structure these withdrawals is a subject for future articles. What I want to do here is help us understand the need for flexibility in the unfortunate circumstance where the sequence of returns is unfavorable.

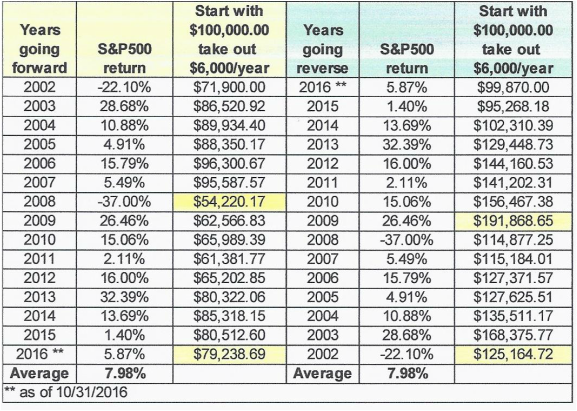

To illustrate this I put together the following table using returns for the S&P 500 for the past 15 years. To make this example meaningful, I've also set up a distribution from the account at a rate of 6% per year. Though I've set the starting value at $100,000, the example is illustrative regardless of the amount.

The table uses S&P 500 returns for the last 15 years going forward on the left side, then uses these same returns, only in reverse order on the right side of the table. Let's take a look at the approximate midpoint of this timeframe (see highlighted numbers). The person experiencing the returns on the left side (years going forward) is probably suffering some anxiety. In contrast, the person that experiences the returns on the right side is probably euphoric. At the end of the 15 year period both have seen some ups and downs. But the person on the right side is clearly feeling quite safe as their balance is greater than their starting point. Not so for the person on the left.

We don't have control over the returns from the market, but there are a number of things we can control. The two most important areas that we can control is our spending in years where we encounter significant downturns, and equally important how we tactically adjust our investments to minimize the effects of significant downturns. When we approach retirement we need to establish guidelines on spending that give us some confidence that we can maintain a sustainable life style over a reasonable projection of our lives. With those guidelines in place we will be better prepared to make the tactical adjustments needed throughout various market cycles.

To illustrate this I put together the following table using returns for the S&P 500 for the past 15 years. To make this example meaningful, I've also set up a distribution from the account at a rate of 6% per year. Though I've set the starting value at $100,000, the example is illustrative regardless of the amount.

The table uses S&P 500 returns for the last 15 years going forward on the left side, then uses these same returns, only in reverse order on the right side of the table. Let's take a look at the approximate midpoint of this timeframe (see highlighted numbers). The person experiencing the returns on the left side (years going forward) is probably suffering some anxiety. In contrast, the person that experiences the returns on the right side is probably euphoric. At the end of the 15 year period both have seen some ups and downs. But the person on the right side is clearly feeling quite safe as their balance is greater than their starting point. Not so for the person on the left.

We don't have control over the returns from the market, but there are a number of things we can control. The two most important areas that we can control is our spending in years where we encounter significant downturns, and equally important how we tactically adjust our investments to minimize the effects of significant downturns. When we approach retirement we need to establish guidelines on spending that give us some confidence that we can maintain a sustainable life style over a reasonable projection of our lives. With those guidelines in place we will be better prepared to make the tactical adjustments needed throughout various market cycles.

RSS Feed

RSS Feed